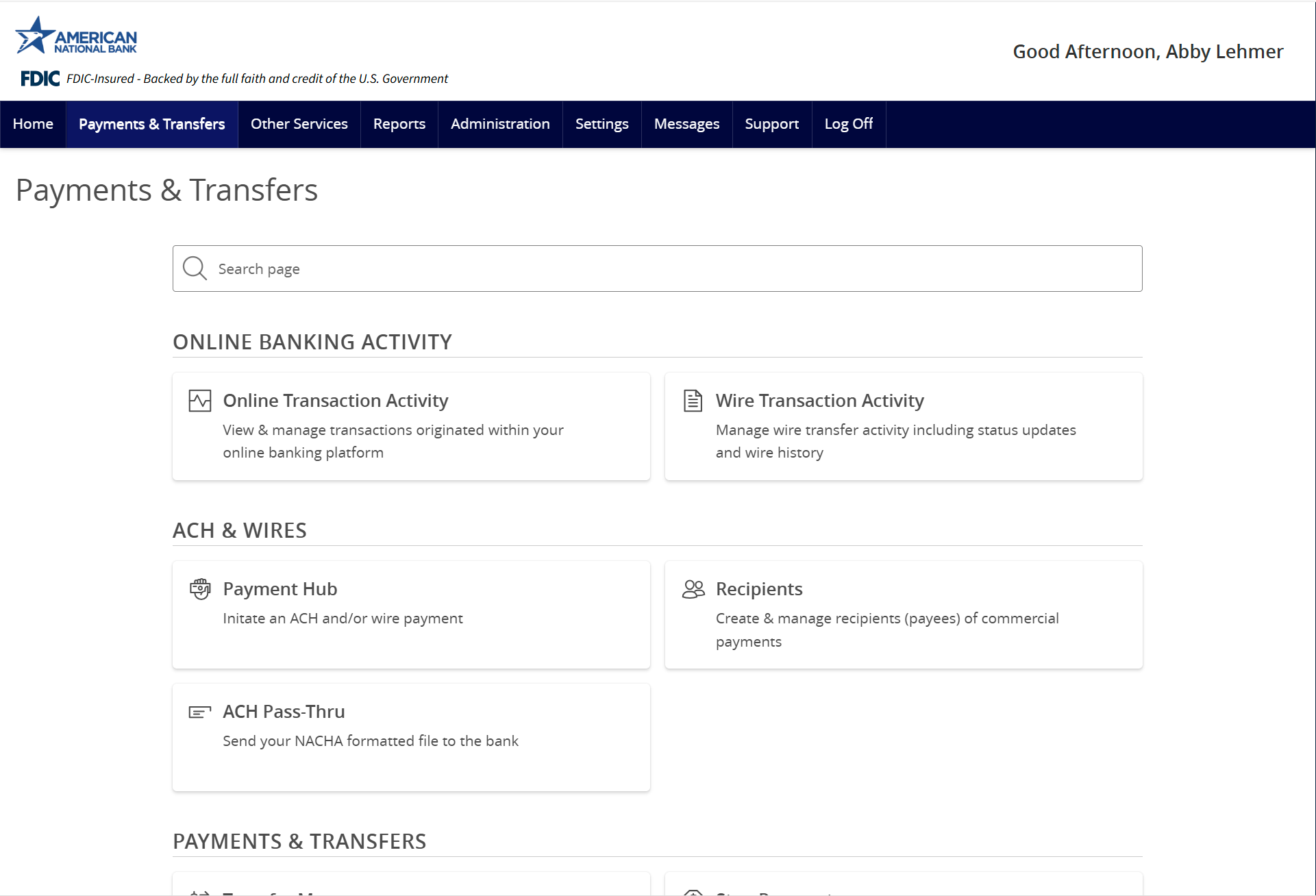

Payments & Transfers

The ‘Payments & Transfers’ tab is your home for moving money quickly and securely. Move funds between accounts, initiate external payments, schedule recurring transfers, view two years of transaction history, stop checks or make loan payments. The dial for efficiency is ready to be turned up a notch.

Key features & what’s new in Payments & Transfers

-

‘Payees’ are now ‘Recipients’

-

Unified mobile and desktop experience

-

See more account history (2 years)

-

Move money faster with same-day ACH

-

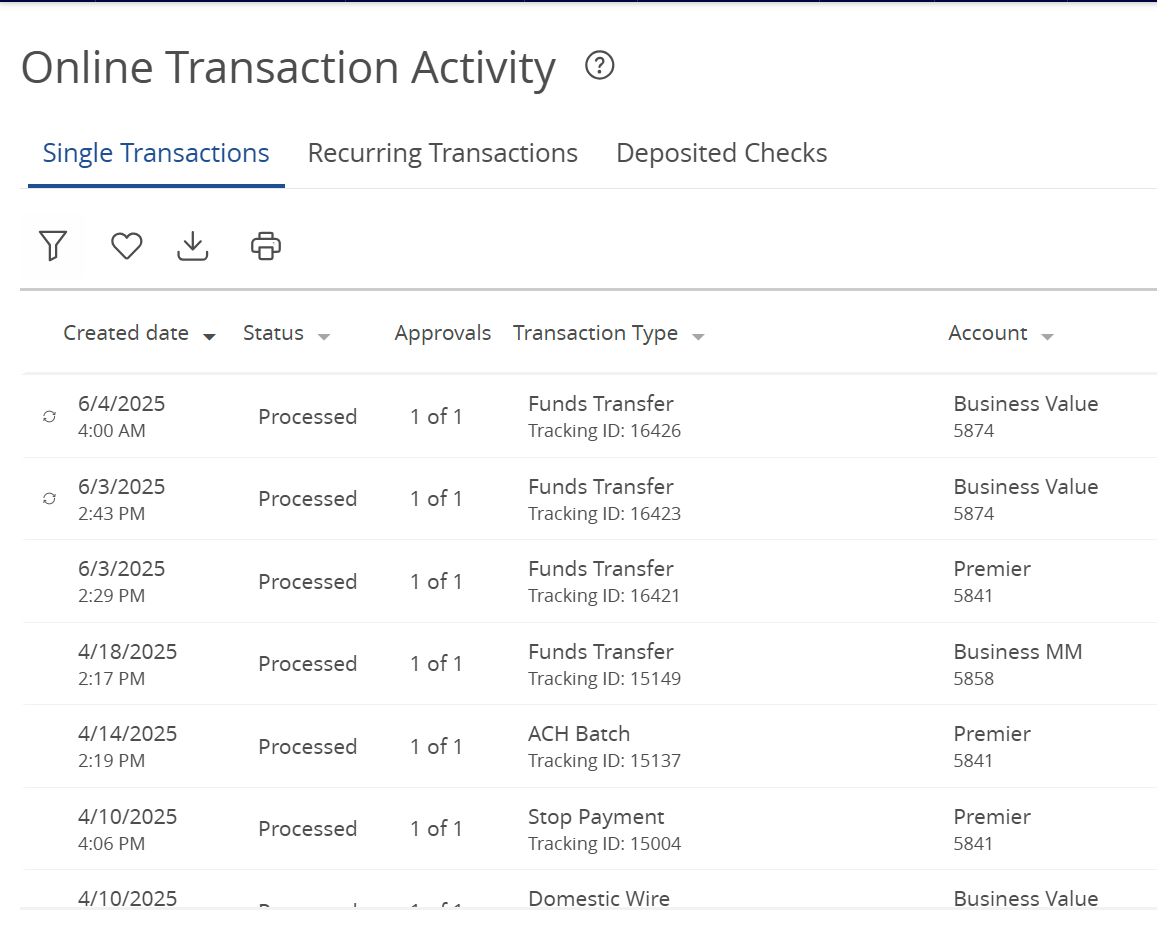

View history for online transactions in ‘Online Transaction Activity’

-

Recurring transfers will be migrated

-

More control for everyone with Stop Payments

Common Payments & Transfers questions

Where can I manage recipients?

A recipient (previously called ‘payee’) is an individual or business that you are sending money to or collecting money from. Learn more about recipient management here.

When do drafted payments need to be approved?

Approvals must happen prior to the scheduled processing date. If it is not approved before processing, the transaction must be re-entered. You can easily re-enter a transaction by visiting the Online Transaction page, clicking the vertical three-dot menu for that transaction, and choosing Copy. You will be taken to the transaction setup page and will simply need to update effective/process date.

What is Stop Payments? Why am I seeing more options to stop a payment on my account?

Stop Payment functionality is now available for all service tiers. You will now see this feature on accounts that may not have had it before, providing greater control to protect your finances and defend against potential fraud.

Will recurring transfers be migrated?

Yes. Recurring ACH transfers will be migrated over in a drafted status and will not process until you reauthorize the transaction. To authorize a transaction, go to Payments & Transfers then Online Transaction Activity. Find the transaction, select the three vertical dots then select Approve.

Learn more

Will future-dated transfers be migrated?

No. Future-dated transfers or payments will not migrate. You will need to re-establish any future-dated transfers or payments once you have successfully accessed ANB Go Business after October 6.

You can delete future-dated transfers in the Payment Center and futured-dated payments in the Transfer Center.Will loan payments be migrated?

If your loan payment is scheduled as a recurring auto transfer it will come over and continue to process as scheduled. If you schedule payments as one-time payments, you can schedule those in Payments & Transfers > Make a Loan Payment.

How do I make a loan payment?

Navigate to Payments & Transfers > Make a Loan Payment and complete the required fields to submit a loan payment.

Do more on the go with expanded cross-device functionality.

Whether you’re banking through a browser or on the mobile app, you’ve got the power to do more from anywhere.

Tutorials & guides

-

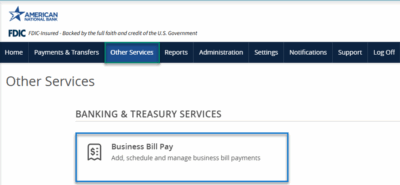

Bill Pay User Guide

Read moreSchedule and manage your payments using Bill Pay.

-

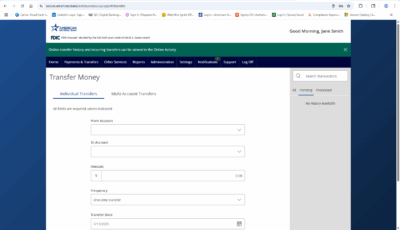

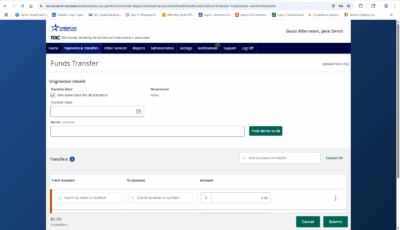

Transfer Money

Read moreFollow these instructions to transfer money in ANB Go Business.

-

Online Transaction Activity

Read moreFollow these instructions to view and search your online transaction activity.

-

Multi-Account Transfers

Read moreFollow these instructions to perform multiple internal account transfers at once.

-

Wire Upload from File

Read moreThe wire upload function allows you to upload a formatted CSV file containing multiple wire transfers instead of inputting the wire information manually.

-

Split Transactions

Read moreThe split transaction option is available for recipients of Payroll transactions who have at least two accounts.