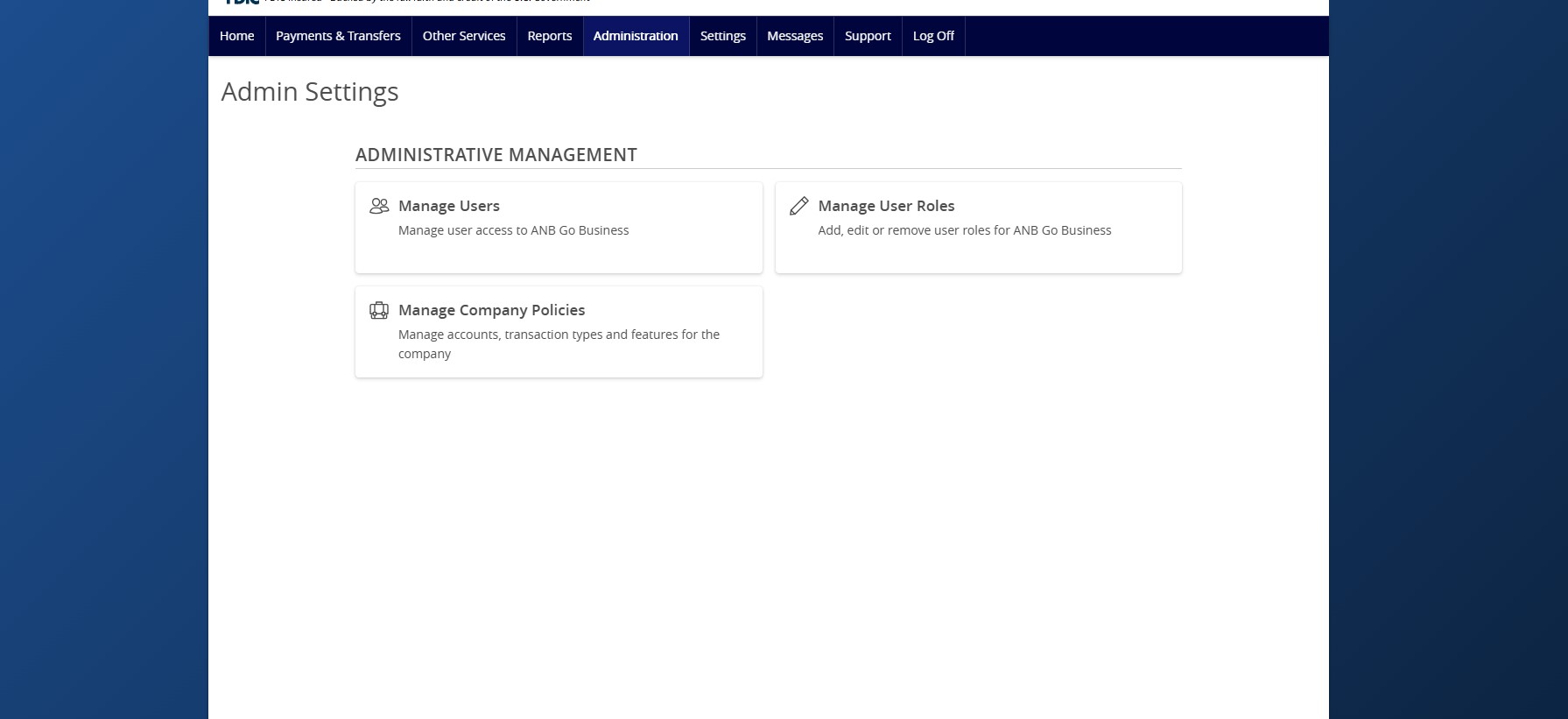

- Select Administration then Manage Company Policies.

- Select a transaction type that you’d like to set parameters around by clicking on the name of the transaction type. For example, ACH Collection.

- Select the Allowed Actions tab.

- Click the three vertical dots.

- Select the Show Details option to view the configurations for the Allowed Action.

- Select the Edit option to edit the Allowed Action.

- Please note that one or multiple levels may be set up to establish general or granular user limitations.

- Under Amount select Any allowable amount or enter an amount using Specific Amount.

- Click the drop-down menu below the Approvals option to select between one and five required approvals for the transaction type.

- The number of approvals designates how many users must approve the transaction before it is fully authorized for the financial institution to process.

- Under Subsidiaries select Any allowed subsidiaries or click the Select specific subsidiaries link to choose specific subsidiaries.

- Under Accounts select Any allowed account or click Select specific account(s) link to choose specific accounts.

- Under Draft Hours select + Add Draft Hours to restrict hours of the day and days of the week when users will be allowed to draft the transactions of the corresponding type. Select the days and hours allowed for this transaction type then click the check mark.

- The Locations option allows the user to choose the country or countries within North America from where this transaction type may be drafted. Select the countries according to need.

- Please note that until any of the countries are selected on the screen, there will be no restriction placed on draft source location. Once a country or countries have been selected, IP addresses sourced from all other countries world-wide will be denied.

- The IP Addresses option allows the user to enter the IP address and/or IP address range to be allowed from where this transaction type may be drafted. All other source IP addresses will be denied.

- The SEC Codes option allows the user to designate which SEC codes are allowed for the corresponding transaction type.

- Click Submit when done.

- Use Policy Tester to validate the Company Policy functionality to assure the setup is correct. This is an optional step.

- If the policy test is unsuccessful, the reason for the failure will be designated on the screen.

- Select the Rights tab to view the dollar and count limits assigned by American National Bank.

- American National Bank sets the approval dollar limits for the Company Policy. This screen is for viewing purposes only and cannot be edited.

- Repeat the previous steps for each transaction type.

- Select the Features tab to view the non-transactional features assigned by American National Bank.

- Select the Accounts tab to view the account rights assigned by American National Bank.

- American National Bank sets the account access for the Company Policy. These settings are for viewing purposes only and cannot be edited.

- Select Save when complete.

Additional resources:

-

Essentials User Management

Read moreFollow these instructions to manage users in ANB Go Business.

-

Enterprise User Management

Read moreFollow these instructions to manage users in ANB Go Business.

-

Creating a New User Role

Read moreFollow these instructions to create a new user role.